Noom | company valuation

Noom is a weight loss mobile app. The company reached ~$400m ARR by EO 2020. As of May 2020, it was valued at $4.2bn. A weight loss app is worth $4.2bn.

Company and Product

Noom was founded in 2008 by Saeju Jeong (CEO) and Artem Petakov (President). The company launched in 2017 and has since become the #16 app in the iPhone app store under Health and Wellness. By EO 2020, the company reached ~$400m revenue and ~2m active users. Noom’s core product is a weight loss mobile app that sells directly to consumers as well as to payers globally. Most users are 30-60 year old women. Noom uses psychology driven methods coupled with human coaches to motivate changes in behavior to help users achieve and maintain weight goals. The app provides users with a set of tools and resources including:

Courses - Short videos on motivation, healthy habits, nutrition, and more

Progress tracking - Food, weight, and other bodily metrics tracking

1x1 coaching - Connect with a real person for additional support and guidance

Groups - community base of other users

3rd party app and device connection - Noom connects with other apps and devices, such as Apple Health and Fitbit for integrated health data tracking

Other resources such as recipes for healthy meals

Market

As gyms, restaurants, and health clinics shut down in 2020 due to the COVID-19 pandemic, consumers turned to digital health and fitness platforms such as Noom to fill the void. The global wellness economy grew to $4.5tn in 2020, and downloads of health and fitness apps grew by 46%. Although COVID accelerated short term adoption, there are lasting, long-term implications. The pandemic brought health and wellness to the front of consumer minds, driving ongoing consumer behavior changes. Furthermore, employers are becoming increasingly interested in going beyond basic healthcare benefits to provide support for employees, manage costs, and boost employee retention. Even as vaccines roll out and gyms and clinics reopen, analysts expect this digital shift to continue to drive industry growth at ~20%+ CAGR over the next few years. Although traditional weight loss programs have seen low growth, more holistic wellness programs such as Noom continue to see positive consumer adoption, as well as increased payer interest.

There are many different mobile apps focused on weight loss at various price points. The two largest market leaders are MyFitnessPal and WW. MyFitnessPal is the industry leader, with ~200m users. Users can set goals, track calories, find workout routines, and more. The app has an entirely free experience as well as a premium experience that costs $20 a month. WW is the largest publicly traded weight loss app company. Besides a mobile app with coaching they also have in-person weekly meetup programs. Additionally, there are more premium apps such as Second Nature. Like Noom, Second Nature focuses on using behavioral change to drive health outcomes.

Besides the companies mentioned above, there are many more competitors in the weight loss space, including My Diet Coach, Fooducation, and Ideal Weight. Furthermore, there are other digital health companies such as Vida Health and Omada that include weight loss as a part of their overall program.

Thesis

Large and Growing TAM: The global wellness industry today represents $4.5tn in size. Within this, mobile health apps are expected to reach ~$150bn market size by 2028 with ~20%+ CAGR. Should Noom be able to successfully demonstrate ROI to users, employers and other partners, the company is well positioned to capture growth.

Secular Tailwinds: Noom stands to benefit from various secular trends.

Especially true in the US, healthcare costs continue to rise, forcing payers to look for alternative methods to manage costs. Chronic conditions associated with obesity can cost employers as much as ~$12,000 incremental per employee per year. These trends drive employers and health plans to increasingly offer various alternative health benefits beyond basic insurance to employees and members. The payers benefit from overall healthcare cost savings, more productive work forces, and higher employee and member retention. Simultaneously, employees and members benefit from access to resources for living healthier lives.

Obesity and chronic conditions continue to rise in both the US as well as globally. However, consumers are also becoming increasingly health conscious. Noom stands to benefit as traditional weight loss programs fail and more people look for ways to manage weight issues.

Strong Revenue Growth: Noom has been able to double revenue year over year for the past three years, reaching ~$400m revenue in 2020. This is a positive sign for product market fit and if the company can keep this momentum, they are well-positioned to become the market leader in a highly competitive space. A key question is can they sustain this growth in a post-COVID world.

Mix Shift Towards Payer Customers: Noom has begun to target large payer customers. Payers represent a more lucrative customer base and distribution channel for reaching end users than going directly to consumers for a variety of reasons. By targeting employers and health plans, Noom could see higher retention rates and better revenue visibility. Additionally, although revenue per employee / member may be lower due to volume discounts, CAC per employee / member is also likely lower. Especially for large enterprise customers, the CAC could be spread across thousands of employees/members. With lower revenue but higher retention and lower CAC, it is possible for Noom to achieve better CLTV/CAC. So far, Noom has been able to secure payer partnerships with major companies including Aetna, Anthem, Samsung, and more. As the company continues to grow, being able to expand this enterprise customer base will be critical.

Additional Opportunities for Growth: The company has already started to explore additional avenues of growth. Besides its core weight loss program, Noom recently launched a mental health platform, called Noom Healthy Mind. Additionally, men only make up ~20% of its users today. The company plans to increase growth within this demographic base. Noom’s weight loss platform represents the “wedge” that the company can use to jump into multiple other adjacent wellness categories, such as mental health, fitness, chronic disease management, and menopause. Furthermore, as the company scales, their database of user data could be a source of additional insight for new app features or new products and services. By adding more products and services, Noom could increase user stickiness and drive greater customer value in the LT.

Backable Founder Team: CEO Saeju Jeong has a track record of entrepreneurship. As a college student, he founded BuyHard, an online retailer for niche music genres and eventually sold it to a competitor. He has also demonstrated incredible perseverance. Noom was founded in 2008, but after working through multiple failed iterations, the company as we know it today finally took off in 2017. Our conversations with Saeju and Artem show that they are incredibly mission driven and have been able to successfully scale with the business and bring in the right talent. We feel confident that this founding team will be able to continue to drive growth for the business moving forward.

Risks

Competition: The weight loss mobile app industry is incredibly crowded with large, incumbent competitors such as WW as well as smaller, cheaper competitors such as My Diet Coach. Noom’s current product differentiation primarily comes from its focus on psychology to drive behavioral change. We already see other startups such as Second Nature copying this model. Furthermore, as they expand into mental health and chronic conditions, they run into more incumbents such as Lyra. However, competition is not always a bad thing and may even be a sign of validation for Noom’s value prop. Despite competition, they have been able to double revenue every year since launch, which is a positive sign. We may need to do more diligence on understanding how their CAC and pricing have trended over time to understand industry competitive dynamics.

End User Churn: Noom has worked well for many users, driving ~7.5% average weight reduction in 6 months. Unfortunately, a good outcome for users means that they no longer need weight loss help and may churn. So the more effective Noom is at driving weight loss, the more their users churn. This creates a strange dynamic where the best interest of the users may not be well-aligned with the best interest of the company. Adding more payer customers would address some of these issues, especially if payers are charged based on overall covered population vs active user population. Furthermore, as a consumer app oriented around a 16 week program, user churn rate is naturally high relative to enterprise software companies. There is little switching cost preventing users from moving to different weight loss programs, using multiple weight loss programs at once, or stop using weight loss programs all together.

Payer Adoption Unclear: With the limited data we have, it is still unclear if the potential ROI and savings Noom can deliver resonates with employers and other partners. So far, they have been able to sign up a few major health plans. We need to do additional diligence on verifying reception with these initial enterprise customers and pipeline of prospective customers.

Valuation

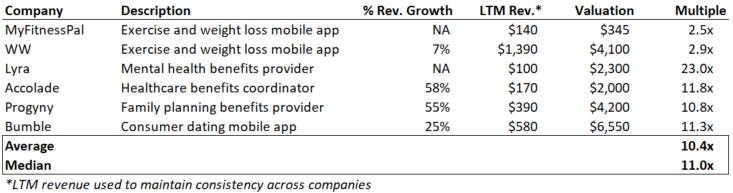

The closest public comp is WW, but given its low growth rate and Noom’s shift to payer customers, we also referenced higher growing healthcare benefits and consumer app companies.

So yea, I guess if you take the 11x multiple and apply it to roughly $400m+ ARR, you get to $4bn+ valuation. I guess the company has doubled in size yoy historically. Welcome to 2021 I guess.