Structured Family Caregiving: The Future of Affordable Senior Care

An overview on how structured family caregiving could play a role in decreasing total healthcare costs and opportunities for new entrants.

As the US population mix continues to shift towards seniors aged 65 and up, the way we care for this population will be a major driver of total healthcare costs. One way to lower the cost of care is by keeping more seniors in their own homes rather than nursing facilities. This article explores how structured family caregiving (SFC) can support this goal, and how companies could succeed in this market.

The US Senior Care Market

According to the US Census, the overall US population will grow 4% over the next decade, while people aged 65 and up will grow 20%, ~5x as fast. This means by 2035, 22% of the population will be aged 65 and older, up from 18% today. This is a big deal because per capita healthcare spend for 65+ is ~$19K, the highest among all age group.

According to congressional research, the US spent ~$470B on senior long term services and support (LTSS) in 2021. Of this, the US government covered ~70% primarily through Medicaid and Medicare, with the rest coming from private insurance and out of pocket sources. This spend is expected to grow at ~6% CAGR in the next 10 years. The way care gets delivered to this senior population will be a key driver of US healthcare costs in the next decade.

There are three main channels for senior LTSS today:

Nursing homes and assisted living facilities – Seniors move out of their homes to live in a facility with support from full-time professional caregivers. This is a mature market with TAM ~$340B today based on industry reports. A nursing home is typically the most expensive option, costing ~$100k per year per senior based on estimates by the Kauffman Foundation. ~60% of this spend goes towards nursing staff and another ~20% goes to room and board. The actual profit margin kept by nursing homes is only ~5-10%.

Home and community based services – Seniors stay in their homes and receive care from various third parties, such as in-home nurses and Meals on Wheels. The TAM for this market is ~$165B.

Family caregiving – Seniors stay in their own homes or move in with loved ones who take care of them. With ~38M caregivers in the US providing an average of ~18 hours of care per week at $16.60 per hour, this represents ~$600B in value. Family caregiving is typically the lowest total cost of care per capita option.

What is Structured Family Caregiving?

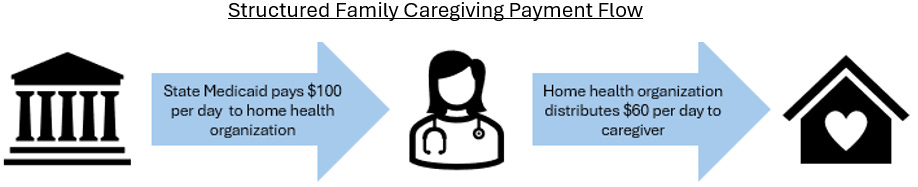

Increasing share towards lower cost family care and away from expensive institutional care with nursing homes could be one arrow in the quiver for managing senior healthcare costs. SFC is one way to achieve this. SFC is typically a Medicaid-funded benefit that compensates primary caregivers of low-income seniors who have disabilities or other challenges that prevent them from living independently. Oftentimes, the caregivers are children, siblings, or spouses, who receive training and support from home health nurses. State Medicaid typically pays ~$100 per day, of which home health providers keep ~$40 for the training, and the remaining ~$60 goes to the caregiver family member. This translates to ~$37K a year for SFC, ~65% lower than the ~$100K average annual cost for a senior to live in a semi-private nursing home room.

Beyond better financial outcomes, SFC drives greater senior happiness and potentially higher quality of care. Multiple consumer surveys show that 70%+ of older adults do not want to go to nursing homes and would prefer to live in their own home or with relatives.

Market Dynamics

SFC programs are multiple decades old in some states, and there is an existing ecosystem of organizations addressing this market. However, because SFC is a state-level Medicaid program with different regulations and nuances in each state, the existing provider landscape is fragmented. For example, the state of Massachusetts alone has ~140 providers, including for-profit providers such as Careforth and We Care 365, as well as non-profit organizations such as Boston Senior Home Care. These organizations are often subscale with complex sign up processes. They lack the technology backbone for driving consumer awareness, consumer engagement, nurse retention, and national scalability.

This could be an interesting market for new entrants with tech enabled solutions for a few reasons:

Underpenetrated TAM: Partially driven by complex paperwork and lack of knowledge, SFC penetration is low, ranging from ~1 to 10% among qualifying families depending on the state. At full penetration, analysts forecast the market to be ~$17B in size from 11 states with active SFC programs today. A possible winning strategy to drive penetration in this market might involve a combination of:

Superior distribution – As a consumer-facing service, strong brand recognition and masterful D2C marketing will be critical for efficiently capturing consumer awareness.

Smooth onboarding – Once a family is aware of your services, an easy digital onboarding process can drive higher conversion rates compared to incumbents’ time intensive, physical processes.

Sticky customer bases: Most seniors who qualify for SFC remain eligible for the rest of their lives. As a result, businesses in this segment could deliver fairly strong revenue visibility with limited volatility. A key driver of customer retention is the family’s long term relationship with their nurse. Companies that are successful in this market will prioritize managing nurse retention, which will in turn promote strong customer retention. Additionally, successful companies will have better nurse efficiency. As the largest cost item, figuring out how to enable each nurse to cover more families will likely be the biggest driver of scale efficiencies.

And the size of the prize could be meaningful. With 5% market share, 15% net income margin, and 20x long term average S&P500 earnings multiple, a company could be worth $2.5B+.

In recent years, a few startups formed to tackle SFC:

Entyre, is a Europe based startup, initially focused on the Swiss market. They recently expanded to the US, starting with Massachusetts. Entyre built a tech enabled platform that makes it easier for families to sign up, and helps nurses more efficiently deliver training to caregivers. Their D2C marketing strategy has enabled them to reach triple digits run rate revenue in less than two years’ time.

Oma Care is a Y Combinator backed startup founded in 2024 with the goal of unlocking greater reimbursement share for family caregivers. Their product has not yet launched, but you can join their waitlist here.

Conclusion

Given the size of the SFC market and low penetration levels of innovative solutions today, I would not be surprised if more companies enter this market in the coming years. As someone lucky enough to still have two living grandparents in their mid 80’s living semi-independently, I recognize the need for better solutions. Americans need to rethink how senior care happens in the coming decade as our population mix increasingly shifts older. If you are building a company in this space, or interested in talking about how the healthcare industry might evolve in the face of shifting demographic trends, please reach out to me at selina@altimeter.com.

Data Sources: US Census, CMS, congressional publications, AARP.org, LEK reports, NIH, Kauffman Foundation, and more.

Disclaimers: The information presented in this newsletter is the opinion of the author and does not necessarily reflect the view of any other person or entity, including Altimeter Capital Management, LP ("Altimeter"). The information provided is believed to be from reliable sources but no liability is accepted for any inaccuracies. This is for information purposes and should not be construed as an investment recommendation. Past performance is no guarantee of future performance. Altimeter is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.