The CCA Program and Anduril’s Role

A deep dive into the most important contract for the US's most important defense company.

On January 25, 2024, Anduril Industries, a seven-year-old startup based in Costa Mesa, CA, was selected as one of five companies to develop Collaborative Combat Aircraft (CCA) products for the US Air Force. Following this, on April 24, Anduril with their Fury aircraft, and General Atomics with their XQ-67A OBSS aircraft, were chosen to advance with a CCA R&D contract. Notably, the three companies that did not advance – Boeing, Lockheed Martin, and Northrop Grumman – are long established defense contractors with a combined enterprise value of $360B and nearly 300 years of history. The CCA is a “big boy” program both by strategic importance and sheer scale. How did Anduril beat out industry goliaths to win a seat at the table for a multi-year, multi-billion-dollar defense contract? Could this signify a changing of the guard from traditional contractors to next generation defense tech? This article is a deep dive into what the CCA program is, and why Anduril won.

CCA History

The CCA program is part of the Air Force’s Next Generation Air Dominance (NGAD) initiative aimed at equipping the US with 6th generation warfighting capabilities. Now reader, you may be wondering: why are we fielding for the 6th generation, when we just spent billions on fielding 5th generation F-35s and F-22s? Unfortunately, the Department of Defense (DoD) has lost a battle with time. Due to long DoD procurement timelines and rapid technology development, new capabilities such as advanced stealth, hypersonic speed, and autonomy must be built into a new generation of DoD programs in order for the US to successfully counter potential adversaries.

Since the 1980s, the U.S. Air Force's 5th generation programs have encountered significant delays and cost overruns. For instance, Lockheed Martin’s F-22 program was initially projected to deliver 750 aircraft for $26B, but ultimately produced only 187 for $67B. High operating costs, obsolescence, and immense production prices have contributed to the F-22's planned retirement starting in 2030, just 18 years after the last plane was delivered.

To address these challenges, DARPA and the U.S. Air Force launched the NGAD initiative in 2014. Between 2014 and 2019, the program concentrated on technical demonstrations and basic research on AI, autonomy, and stealth technology. Key contributors to the initial studies and prototypes included MIT Lincoln Laboratory, Georgia Tech Research Institute, Boeing, Lockheed Martin, and Northrop Grumman, all funded by the DoD.

In 2019 and 2020, NGAD activity accelerated as the Air Force established a Program Executive Office (PEO) and outlined more concrete goals, including plans for a manned centerpiece aircraft supported by 'loyal wingman' which evolved into the CCA. During this period, Boeing unveiled the MQ-28 Ghost Bat, an unmanned aircraft designed for the CCA program. Concurrently, the Air Force launched the Skyborg program, which funded Boeing, Northrop Grumman, Kratos, and General Atomics to prototype CCAs.

In early 2023, Air Force Secretary Frank Kendall announced plans to procure at least 1,000 CCAs. On January 24, 2024, the Air Force selected five companies—Boeing, Lockheed Martin, Northrop Grumman, General Atomics, and Anduril—to advance in the development of CCAs. By April 24, 2024, the Air Force had narrowed its development contract to include only Anduril and General Atomics.

Why is the CCA Program Important?

The CCA is incredibly important from a strategic angle for a variety of reasons:

Force Multiplier: The US military is facing a staffing shortage. In FY 2023, every branch of the military, except the Marine Corps, missed some aspect of recruitment targets. Research from the DoD’s Office of People Analytics indicated that in 2022, only 9% of young adults considered serving in the military, compared to 36% in the 1980s. Additionally, the US Air Force is now the smallest and oldest it has ever been, with ~2.2k fighter aircrafts, less than half of the size of its 1990 fleet. To address these challenges, the military needs more unmanned systems to extend the capabilities of each individual. The CCA program addresses this by pairing a single manned fighter with 2-5 unmanned aerial vehicles (UAVs), enabling the Air Force to achieve more with fewer personnel and reducing the risk to human life during conflicts.

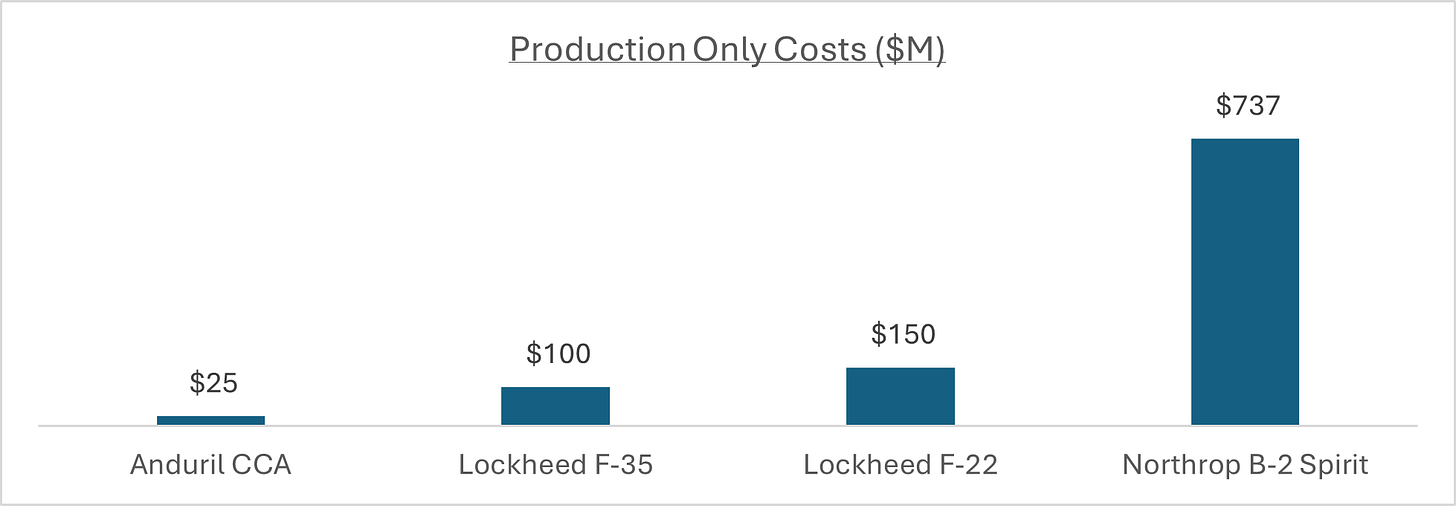

Cost Efficiency: One of the CCA program's primary objectives is to deliver lower-cost, attritable systems. This marks a departure from the U.S.'s historical focus on large, expensive, all-dazzling hardware. For example, Northrop Grumman’s B-2 Spirit costs ~$737M per unit just to manufacture, and $2.1B total per unit including development costs. It is a really bad day when a B-2 Spirit goes under. In contrast, a CCA is estimated to cost ~$20-30M each. With cheaper, disposable systems, the DoD hopes to save money on both upfront production costs as well as ongoing maintenance costs without compromising combat effectiveness.

Technological Dominance: The CCA allows the US to maintain military technology leadership. The nature of warfare has fundamentally transformed over the past decade. Parties dealing with the war in Ukraine and the Houthi attacks in the Red Sea demonstrate that cheap, mass-produced drones – whether autonomous or human-in-the-loop – are incredibly valuable. For instance, the Ukrainian army used off-the-shelf drones to counterbalance the superior numbers and equipment of the Russian military. For all the aforementioned reasons, and most importantly, protecting American lives – autonomy is on the critical path of US military technology development over the next decade. Gartner estimates that by 2025, over 75% of defense organizations will be testing or implementing autonomous systems beyond drones. The CCA is set to bring these autonomous capabilities to the forefront of US defense strategy.

In July 2023, the Mitchell Institute, a nonpartisan national security think tank, hosted a wargame to explore how a mix of CCAs and crewed combat aircraft could achieve the degree of air superiority required to defeat adversary aggression. The wargame scenario was a hypothetical defense of Taiwan, focusing on the first two weeks of a conflict with China. In this demonstration, CCAs successfully showed their ability to:

Act as lead forces to overwhelm, disorient, and degrade the enemy’s air defenses before the arrival of crewed combat aircraft

Act in significant numbers as airborne decoys, jammers, active emitters, and weapon launchers

Deplete enemy air-to-air and surface-to-air missiles

Extend sensors and weapons ranges of manned aircraft to increase their lethality and survivability

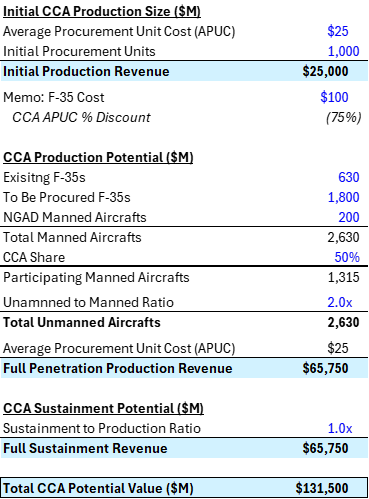

The CCA is also a massive program from a dollars at play angle. Air Force Secretary Frank Kendall announced plans to acquire at least 1,000 units, with each CCA estimated to cost approximately $20-30M, which is around 70-80% cheaper than an F-35. This equates to a minimum of $25B for the initial production contract. With deeper fleet integration, the production contract value could exceed $65B. Furthermore, sustainment contracts, which are typically more than double the size of the initial production contract, could increase the total program value to over $130B.

Why did Anduril Win?

5 years ago, it would have been unthinkable for Boeing, Lockheed Martin, and Northrop Grumman to all lose out on the CCA R&D contract. Anduril’s victory over these incumbents is a remarkable achievement, considering they have been working on their next-generation platforms for the past decade. So, what led to Anduril’s success? While the details of the exact selection criteria and marks of each company are not publicly available, we attribute Anduril’s success to three main factors:

Counter-positioning: Traditional defense companies often operate under cost-plus contracts, where the DoD pays a fixed percentage premium above the cost of production to ensure profitability for the contractor. As a result, these companies are reluctant to invest off their own balance sheet and prefer to conduct R&D when they can expense it to the DoD. While this model protects contractors from financial losses on high-risk projects, it also incentivizes them to inflate costs to maximize profit dollars. This is good for contractors, but bad for the DoD and taxpayers. In contrast, Anduril is comfortable with funding R&D with their own balance sheet and prioritizes fixed-cost contracts. Here, contract value is agreed to first and Anduril independently manages costs. This incentivizes Anduril to minimize expenses so they can retain a higher profit share. Cost minimization, coupled with a greater mix of higher margin software revenue, helps Anduril achieve more aggressive bids on contracts, which incrementally increases their chance of winning against traditional contractors. Former employees of Northrop Grumman and Boeing estimate that Anduril's CCA price per unit submission was likely 10-25% lower than those of traditional defense contractors.

Software-first approach: Unlike traditional defense contractors, Anduril is a software-native company. Fittingly, the company’s mission statement is “autonomy for every mission”. Its Lattice software operating system is the market-leading product for defense autonomy and AI, capable of integrating various unmanned systems, processing real-time data, and enabling autonomous decision-making. This gives Anduril a leg up in any contract where autonomous capabilities are a core requirement. The strength and flexibility of the Lattice platform allows Anduril to be hardware agnostic. In fact, Anduril didn’t even design their CCA hardware themselves – they acquired a company called Blue Force Technologies for an undisclosed amount in September 2023, which gave them Fury, a group V aircraft (171-214 ft wingspan, 60-66 ft tail height). At the time of acquisition, Fury had not yet completed a first flight. Anduril’s Chief Strategy Office Christian Brose noted, “What’s really exciting is not just continuing to mature the aircraft, but integrating Fury with the software Lattice for Mission Autonomy to really put together an integrated capability that can do real missions for operational users and solve real problems autonomously.” To be clear, the Air Force definitely cares about buying the best hardware with the optimal cost / capabilities balance. But having the right software paired with that hardware maximizes the system’s ability to delivery maximum bang for buck, and this is where Anduril’s Lattice shines.

Anduril was able to quickly mature the Fury hardware and integrate Lattice to deliver a system that got Anduril to be one of five in the initial January 2024 down-selection. Meanwhile, other defense contractors began developing for the CCA a decade ago, starting with hardware and then trying to back into the right software. For example, Kratos began working on their XQ-58A Valkyrie in 2015, but got cut from the contract consideration set in January 2024.

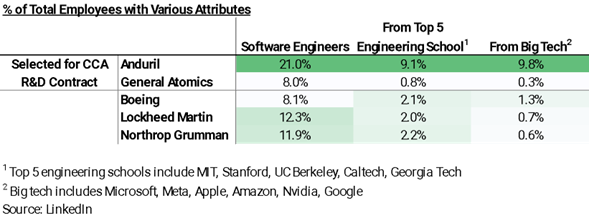

Talent density: Advanced autonomous software requires top-tier engineering talent, and Anduril excels in attracting such talent compared to incumbents. For example, ~10% of Anduril’s employee base came from big tech and ~9% went to a top 5 engineering school. In comparison, less than 1% of Lockheed’s employees are from big tech and ~2% are from a top 5 engineering school. Anduril benefits from a virtuous cycle where top talent attracts more top talent, giving them real talent advantages over competitors.

What’s Next for Anduril?

Being selected as one of two companies for the CCA R&D contract is a monumental achievement for Anduril. However, the critical question remains: Will Anduril secure a significant share of the CCA production contracts? The DoD has made it clear that whoever designs an aircraft is not guaranteed to get the production contract. Anyone can still submit bids for the production contract, but they will have to foot their own bill for development costs. Traditional primes could do this, although they are accustomed to getting paid cost plus for R&D, and they operate on fairly thin margins (~11% EBIT margin) with little wiggle room for unsubsidized major expenses. My best estimate for when the production contract will be awarded is ~2026-2027.

If Anduril wins a production contract, the next biggest question is how will they manage large-scale manufacturing. At full production capacity, they will need to produce hundreds of CCAs per year, and manufacturing a UAV is orders of magnitude more complex than manufacturing a stationary sentry tower. The production process for prior generation aircrafts will also not suffice. At peak production rate, Lockheed was only making ~24 F-22s per year. And F-35s finally reached full-rate production at ~156 units this year, 23 years after the initial contract was awarded. CCA manufacturing will need to reach greater scale at a faster pace.

If Anduril is able to figure out manufacturing at scale, the next key consideration is profit margins. Traditional defense contractors have ~11% EBIT margins and 8% FCF margins, whereas mature software companies have 20%+ FCF margins. Will Anduril’s software capabilities blend up overall program margins? Additionally, given that CCAs will be attritable systems, will the sustainment contracts be smaller? (Typically, sustainment contracts are also higher margin contracts.)

If Anduril can secure the production contract and manufacture CCAs profitably at scale, the next question is will they win subsequent CCA contracts? The initial 1,000 units will not suffice to meet all CCA needs, and industry experts anticipate that the Navy will also procure autonomous capabilities for their aerial fleet in the future. Anduril’s performance in current CCA contracts will be crucial in positioning them for future opportunities.

Conclusion

As the DoD advances the Third Offset Strategy to address challenges posed by peer adversaries such as China and Russia, autonomous and AI led systems such as the CCA will play an increasingly important role. We are just at the early innings of the DoD’s 6th generation programs, and the CCA marks a major step in the direction of autonomy for modern warfare. With the incredible pace of innovation shown by Anduril over the past seven years, I am optimistic about America’s future and the company’s future in supporting CCA programs and beyond.

Special thank you to Erik Kriessmann for providing feedback and ideas for this piece.

Disclaimer: This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

This is an excellent article on the CCA program, but I wanted to challenge a couple of the points.

1. The assumptions about both unit cost and number of units seem aggressive. On unit cost Anduril (though they have not units costs) are targeting costs between $2m and $20m. On unit size, while it is important to mentioned that Anduril has only been selected for Increment 1 of the program. Increment 2 is a separate evaluation likely to require different, more specific capabilities. IMO Anduril is not in a preferential position here as other contractors can design to these capabilities having not been a part of increment 1. More importantly, there is doubling counting of the unit numbers. Kendall's comments were he saw initial contract of 100 and total requirement for 1,000 CCAs. I would take the total contract size as much closer to $25bn with sustainment on top.

2. The counter positioning on the cost of Fury was also due to reduced capabilities. The head of Lockheed's skunk works mentioned Lockheed was developing a more stealthily version of the aircraft, it believe would be more suited to AF's long term needs. The ultimately lost out because of the AF preference for more expendable designed. The point being that the 10-15% lower unit cost is not any secret sauce from Anduril's its because its a less capable aircraft (though purposely so!).

3. Finally Anduril's development of Fury was not self funded. Fury was the result of an acquisition of Blue Force Technologies, where the Fury was part funded through other Air Force contracts for drones to act as adversaries in training.